Mastering MLRO Training and Retention for Financial Integrity

Published on March 8, 2024

What makes this worth your read?

In the dynamic realm of cryptoasset compliance, Money Laundering Reporting Officers (MLROs) stand as sentinels of integrity and accountability. This article delves into the challenges of MLRO retention and emphasizes the significance of robust training and development programs. By addressing these issues, firms can bolster their compliance functions, uphold regulatory standards, and thrive in the ever-evolving landscape of cryptoasset regulation.

In the dynamic realm of cryptoasset compliance, Money Laundering Reporting Officers (MLROs) stand as sentinels of integrity and accountability. This article delves into the challenges of MLRO retention and emphasizes the significance of robust training and development programs. By addressing these issues, firms can bolster their compliance functions, uphold regulatory standards, and thrive in the ever-evolving landscape of cryptoasset regulation.

Quick Read

Navigating a Multitude of Challenges: Money Laundering Reporting Officers (MLROs) in the cryptoasset sector face a myriad of obstacles, from regulatory complexities to the critical issue of retention. As stalwarts of integrity, MLROs play a crucial role in steering firms through the intricacies of compliance.

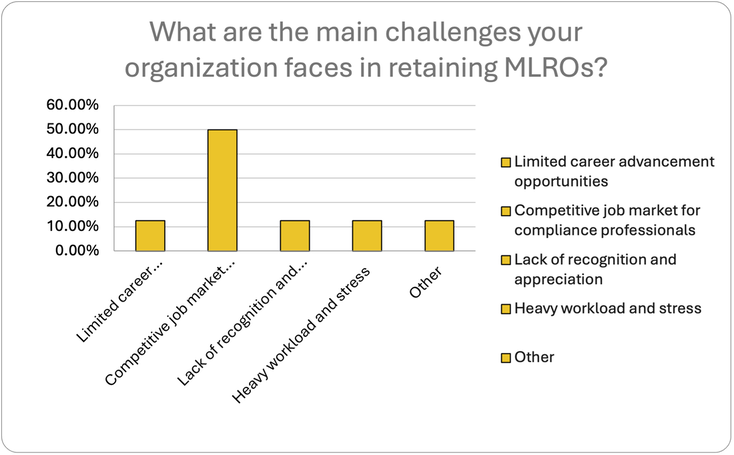

The Challenge of Retention: The retention of MLROs poses a significant challenge for firms, influenced by factors such as burnout, dissatisfaction with training, and lucrative opportunities elsewhere. Disparities in resources between established banks and start-ups further impact job satisfaction and retention rates.

Regulatory Uncertainty: MLROs must navigate a labyrinth of evolving regulatory frameworks, grappling with ambiguity and uncertainty. The fast-paced nature of the crypto industry adds complexity, requiring MLROs to stay abreast of regulatory developments and ensure compliance across jurisdictions.

Technology and Product Development: The rapid pace of technological advancement presents both opportunities and challenges for MLROs. Staying ahead of emerging typologies of financial crime and adapting compliance frameworks accordingly is paramount.

Training for Success: Comprehensive training programs are essential for equipping MLROs with the skills and knowledge to navigate the complex landscape of cryptoasset compliance. Investing in innovation, adopting a risk-based compliance framework, and fostering cultural awareness are key to success.

Industry Collaboration: Collaborative efforts within the industry and support from regulatory bodies are vital for addressing retention challenges and driving sustainable compliance outcomes. By prioritizing the professional development of MLROs, firms can fortify their compliance efforts and pave the way for long-term success in the digital age.

Navigating a Multitude of Challenges: Money Laundering Reporting Officers (MLROs) in the cryptoasset sector face a myriad of obstacles, from regulatory complexities to the critical issue of retention. As stalwarts of integrity, MLROs play a crucial role in steering firms through the intricacies of compliance.

The Challenge of Retention: The retention of MLROs poses a significant challenge for firms, influenced by factors such as burnout, dissatisfaction with training, and lucrative opportunities elsewhere. Disparities in resources between established banks and start-ups further impact job satisfaction and retention rates.

Regulatory Uncertainty: MLROs must navigate a labyrinth of evolving regulatory frameworks, grappling with ambiguity and uncertainty. The fast-paced nature of the crypto industry adds complexity, requiring MLROs to stay abreast of regulatory developments and ensure compliance across jurisdictions.

Technology and Product Development: The rapid pace of technological advancement presents both opportunities and challenges for MLROs. Staying ahead of emerging typologies of financial crime and adapting compliance frameworks accordingly is paramount.

Training for Success: Comprehensive training programs are essential for equipping MLROs with the skills and knowledge to navigate the complex landscape of cryptoasset compliance. Investing in innovation, adopting a risk-based compliance framework, and fostering cultural awareness are key to success.

Industry Collaboration: Collaborative efforts within the industry and support from regulatory bodies are vital for addressing retention challenges and driving sustainable compliance outcomes. By prioritizing the professional development of MLROs, firms can fortify their compliance efforts and pave the way for long-term success in the digital age.

Exploring the Challenges of MLRO Retention and Compliance Culture in the Crypto and Fintech Space

MLRO support is your Key to Long-Term Stability and Success

In the ever-changing landscape of cryptoasset compliance, MLROs serve as the stalwart guardians of integrity and accountability. By addressing the challenges of retention and prioritizing the training and development of MLROs, firms can fortify their compliance functions, uphold regulatory standards, and navigate the turbulent waters of cryptoasset regulation with skill and expertise. In doing so, they not only safeguard their operations but also cultivate a culture of compliance that is essential for long-term success in the dynamic world of cryptoasset.

Navigating a Multitude of Challenges

In the intricate realm of cryptoasset compliance, MLROs serve as the guiding compass, steering their organizations through the turbulent seas of regulatory scrutiny; however, beneath the surface lies a plethora of challenges that MLROs must navigate, from the evolving regulatory landscape to the critical issue of retention.

The role of a well-trained MLRO is indispensable in safeguarding the integrity of cryptoasset operations. Cryptoasset firms operate within a labyrinth of regulatory frameworks, where compliance requirements are as dynamic as the market itself. At the heart of this regulatory web lies the figure of the MLRO, a crucial player responsible for steering firms through the complexities of regulation, in particular Anti-Money Laundering (AML) regulations.

However, in November 2024, the UK Financial Conduct Authority (FCA) issued a letter addressing concerns surrounding MLRO retention. The letter highlighted issues impacting the sustainability and effectiveness of AML and Counter-Terrorist Financing (CTF) programs and raised questions about MLRO training and compliance culture within the industry.

In the ever-changing landscape of cryptoasset compliance, MLROs serve as the stalwart guardians of integrity and accountability. By addressing the challenges of retention and prioritizing the training and development of MLROs, firms can fortify their compliance functions, uphold regulatory standards, and navigate the turbulent waters of cryptoasset regulation with skill and expertise. In doing so, they not only safeguard their operations but also cultivate a culture of compliance that is essential for long-term success in the dynamic world of cryptoasset.

Navigating a Multitude of Challenges

In the intricate realm of cryptoasset compliance, MLROs serve as the guiding compass, steering their organizations through the turbulent seas of regulatory scrutiny; however, beneath the surface lies a plethora of challenges that MLROs must navigate, from the evolving regulatory landscape to the critical issue of retention.

The role of a well-trained MLRO is indispensable in safeguarding the integrity of cryptoasset operations. Cryptoasset firms operate within a labyrinth of regulatory frameworks, where compliance requirements are as dynamic as the market itself. At the heart of this regulatory web lies the figure of the MLRO, a crucial player responsible for steering firms through the complexities of regulation, in particular Anti-Money Laundering (AML) regulations.

However, in November 2024, the UK Financial Conduct Authority (FCA) issued a letter addressing concerns surrounding MLRO retention. The letter highlighted issues impacting the sustainability and effectiveness of AML and Counter-Terrorist Financing (CTF) programs and raised questions about MLRO training and compliance culture within the industry.

Are retention challenges solely a result of compliance culture, or are there deeper issues at play

The reasons behind this trend are multifaceted, ranging from burnout due to excessive workload to dissatisfaction stemming from inadequate training and support. Moreover, the allure of lucrative opportunities in a burgeoning industry often lures seasoned MLROs away, leaving a void in expertise and institutional knowledge.

i. Lack of Resources

The diversity of MLRO roles also poses unique challenges for retention. In established banks, MLROs often benefit from experience and robust resources, whereas those in startups or smaller firms may face greater pressures and limited resources. The disparity in roles and resources can further impact job satisfaction and retention rates.

The diversity of MLRO roles also poses unique challenges for retention. In established banks, MLROs often benefit from experience and robust resources, whereas those in startups or smaller firms may face greater pressures and limited resources. The disparity in roles and resources can further impact job satisfaction and retention rates.

ii. Regulatory Maze Unveiled

The fast-paced nature of the crypto and fintech space presents both opportunities and challenges. The evolving regulatory landscape adds another layer of complexity. Regulatory requirements vary across jurisdictions, leading to inconsistent compliance standards. MLROs must stay abreast of regulatory developments and ensure alignment with evolving standards, adding to the demands of their roles.

MLROs in these sectors must navigate evolving regulatory frameworks, often facing ambiguity and uncertainty. For MLROs, grappling with the nuances of cryptoasset regulation is akin to traversing a labyrinth, where the rules of engagement are in a constant state of flux. At times, MLROs find themselves ensnared in a state of confusion, grappling with the perplexing dilemma of determining the correct course of action and discerning internal cross border confusion in differing regulatory regimes.

The fast-paced nature of the crypto and fintech space presents both opportunities and challenges. The evolving regulatory landscape adds another layer of complexity. Regulatory requirements vary across jurisdictions, leading to inconsistent compliance standards. MLROs must stay abreast of regulatory developments and ensure alignment with evolving standards, adding to the demands of their roles.

MLROs in these sectors must navigate evolving regulatory frameworks, often facing ambiguity and uncertainty. For MLROs, grappling with the nuances of cryptoasset regulation is akin to traversing a labyrinth, where the rules of engagement are in a constant state of flux. At times, MLROs find themselves ensnared in a state of confusion, grappling with the perplexing dilemma of determining the correct course of action and discerning internal cross border confusion in differing regulatory regimes.

iii. Technology and Product Development: The Fast Lane

With the rising sophistication of Blockchain analytics and the discovery of historical financial crime coins, MLROs must stay one step ahead, deciphering emerging typologies of financial crime and fortifying their compliance frameworks accordingly.

Yet, the real challenge lies in the execution – deciphering these nuances while navigating stringent regulatory applications to weathering the relentless scrutiny of regulators, MLROs face a daunting uphill battle.

In addition, the rapid emergence of new products and services adds complexity to compliance efforts, requiring continuous adaptation and upskilling.

With the rising sophistication of Blockchain analytics and the discovery of historical financial crime coins, MLROs must stay one step ahead, deciphering emerging typologies of financial crime and fortifying their compliance frameworks accordingly.

Yet, the real challenge lies in the execution – deciphering these nuances while navigating stringent regulatory applications to weathering the relentless scrutiny of regulators, MLROs face a daunting uphill battle.

In addition, the rapid emergence of new products and services adds complexity to compliance efforts, requiring continuous adaptation and upskilling.

Effective Strategies for Success

i. Investing in MLRO Expertise is the Key to Long-Term Success

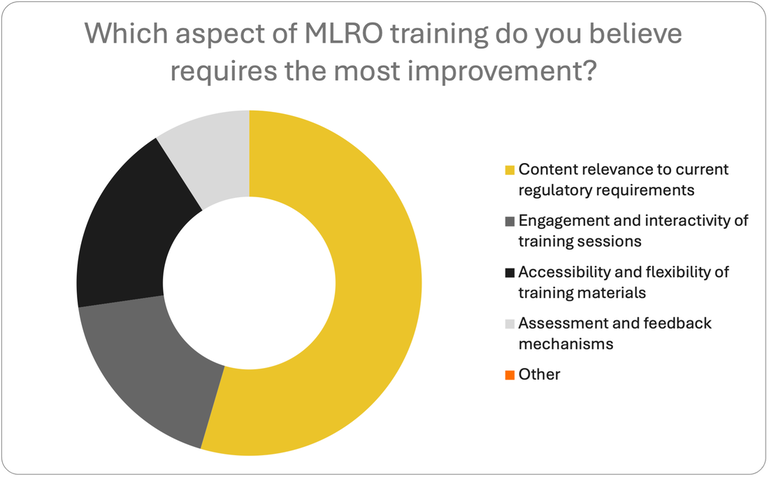

Amidst the challenges of retention and regulatory complexity, the importance of comprehensive training for MLROs cannot be overstated. The dearth of comprehensive training and development opportunities exacerbates retention challenges. MLROs transitioning from traditional banking to crypto or fintech firms may encounter steep learning curves and inadequate support systems. The lack of standardized frameworks and best practices further complicates the situation, leaving MLROs to navigate uncharted territory.

A well-trained MLRO is not only equipped to navigate the intricate maze of cryptoasset compliance but also empowered to drive a culture of risk awareness and accountability within their organization. By providing MLROs with the requisite knowledge and tools to effectively discharge their duties, firms can mitigate turnover, foster continuity, and uphold the highest standards of regulatory compliance.

As the cryptoasset landscape continues to evolve, the need for well-trained and experienced MLROs has never been greater. Firms must recognize the pivotal role that MLROs play in safeguarding their operations and invest in their professional development accordingly. From specialized training programs to ongoing mentorship and support, organizations must prioritize the cultivation of expertise within their compliance functions, ensuring that MLROs are equipped with the skills and knowledge to navigate the regulatory seas with confidence and competence.

Amidst the challenges of retention and regulatory complexity, the importance of comprehensive training for MLROs cannot be overstated. The dearth of comprehensive training and development opportunities exacerbates retention challenges. MLROs transitioning from traditional banking to crypto or fintech firms may encounter steep learning curves and inadequate support systems. The lack of standardized frameworks and best practices further complicates the situation, leaving MLROs to navigate uncharted territory.

A well-trained MLRO is not only equipped to navigate the intricate maze of cryptoasset compliance but also empowered to drive a culture of risk awareness and accountability within their organization. By providing MLROs with the requisite knowledge and tools to effectively discharge their duties, firms can mitigate turnover, foster continuity, and uphold the highest standards of regulatory compliance.

As the cryptoasset landscape continues to evolve, the need for well-trained and experienced MLROs has never been greater. Firms must recognize the pivotal role that MLROs play in safeguarding their operations and invest in their professional development accordingly. From specialized training programs to ongoing mentorship and support, organizations must prioritize the cultivation of expertise within their compliance functions, ensuring that MLROs are equipped with the skills and knowledge to navigate the regulatory seas with confidence and competence.

ii. Innovation is Key

The integration of technology as a potent weapon in the compliance arsenal. By harnessing automation and cutting-edge tools, firms can streamline processes, mitigate risks, and ensure sustainable compliance practices. This technological leap not only enhances efficiency but also bolsters resilience in the face of regulatory scrutiny.

iii. Risk-Based Compliance Framework

Central to effective compliance is the construction of a robust risk-based framework tailored to the idiosyncrasies of the cryptoasset landscape. MLROs are tasked with conducting meticulous risk assessments, pinpointing vulnerabilities across products, geographical reach, and client demographics.

Armed with this insight, firms can erect formidable compliance structures that prioritize high-risk areas while maintaining regulatory adherence across all fronts. This proactive approach not only shields firms from potential pitfalls but also cultivates a culture of risk awareness and accountability within the organization.

iv. Cultural Awareness and Emotional Intelligence

The significance of cultural alignment and emotional intelligence in fostering collaborative relationships with senior executives should never be underestimated. MLROs must gauge the pulse of their organizations, adapting their approaches to suit the unique dynamics at play.

v. Industry Collaboration

There are opportunities for collaboration and improvement within the industry. Industry groups, such as Crypto UK, can play a pivotal role in advocating for supportive regulatory measures and facilitating knowledge-sharing initiatives. Additionally, collective efforts within the compliance community can foster a culture of collaboration and support, enabling MLROs to navigate challenges more effectively.

The integration of technology as a potent weapon in the compliance arsenal. By harnessing automation and cutting-edge tools, firms can streamline processes, mitigate risks, and ensure sustainable compliance practices. This technological leap not only enhances efficiency but also bolsters resilience in the face of regulatory scrutiny.

iii. Risk-Based Compliance Framework

Central to effective compliance is the construction of a robust risk-based framework tailored to the idiosyncrasies of the cryptoasset landscape. MLROs are tasked with conducting meticulous risk assessments, pinpointing vulnerabilities across products, geographical reach, and client demographics.

Armed with this insight, firms can erect formidable compliance structures that prioritize high-risk areas while maintaining regulatory adherence across all fronts. This proactive approach not only shields firms from potential pitfalls but also cultivates a culture of risk awareness and accountability within the organization.

iv. Cultural Awareness and Emotional Intelligence

The significance of cultural alignment and emotional intelligence in fostering collaborative relationships with senior executives should never be underestimated. MLROs must gauge the pulse of their organizations, adapting their approaches to suit the unique dynamics at play.

v. Industry Collaboration

There are opportunities for collaboration and improvement within the industry. Industry groups, such as Crypto UK, can play a pivotal role in advocating for supportive regulatory measures and facilitating knowledge-sharing initiatives. Additionally, collective efforts within the compliance community can foster a culture of collaboration and support, enabling MLROs to navigate challenges more effectively.

Key Takeaways

Cryptoasset regulation remains a complex and ever-changing terrain, demanding constant vigilance and adaptability from industry players.

As the cryptoasset industry matures, the role of compliance professionals becomes increasingly pivotal in navigating the regulatory minefield. By embracing technological innovation, fostering collaborative partnerships, and adopting a proactive risk-based approach, firms can chart a course through uncertainty and emerge as stalwarts in a rapidly evolving regulatory landscape.

However, the retention challenges facing MLROs in the crypto and fintech space are multifaceted, stemming from a combination of cultural, regulatory, and operational factors.

Addressing these challenges requires a concerted effort from regulators, industry stakeholders, and the compliance community at large. By fostering a culture of collaboration and investing in comprehensive training and support systems, we can empower MLROs to navigate the complexities of their roles and drive sustainable compliance outcomes in the digital age.

By heeding these insights firms can begin to fortify their compliance efforts, safeguard their operations, and pave the way for sustained success amidst regulatory turbulence.

As the cryptoasset industry matures, the role of compliance professionals becomes increasingly pivotal in navigating the regulatory minefield. By embracing technological innovation, fostering collaborative partnerships, and adopting a proactive risk-based approach, firms can chart a course through uncertainty and emerge as stalwarts in a rapidly evolving regulatory landscape.

However, the retention challenges facing MLROs in the crypto and fintech space are multifaceted, stemming from a combination of cultural, regulatory, and operational factors.

Addressing these challenges requires a concerted effort from regulators, industry stakeholders, and the compliance community at large. By fostering a culture of collaboration and investing in comprehensive training and support systems, we can empower MLROs to navigate the complexities of their roles and drive sustainable compliance outcomes in the digital age.

By heeding these insights firms can begin to fortify their compliance efforts, safeguard their operations, and pave the way for sustained success amidst regulatory turbulence.

Written by Oonagh van den Berg, CEO & Founder of RAW Compliance and Virtual Risk Solutions (VRS). She is an award winning compliance officer with over 20 years’ experience in financial services. She is one of the leading voices and trainers globally in compliance risk management and has built and led various compliance risk framework developments and teams across the industry for a diverse range of financial entities, including traditional banks, Fintechs, and Crypto firms. She is also an advocate for ethical compliance leadership and framework development, with increased automation including AI and Machine Learning integration.

Edited by Tom Griffiths, Co-Founder and Managing Partner of BitCompli. He has over 20 years of experience working within regulatory operations and compliance, spending 9 years in banking and traditional finance before spending the subsequent 9 years working as a management consultant specialising in regulatory projects primarily at a board level within the regulated financial service industry. Since 2019, he has worked within the cryptoasset industry and was the Chief Compliance Officer & MLRO for Digivault, the first standalone cryptoasset custodian registered with the FCA.