Unveiling the Underworld: Insights from the RAW Compliance Webinar on Underground Banking, AML Typologies, and Emerging Threats

Published on April 2, 2024

Navigating through the labyrinthine networks of illicit financial flows, illuminating the modus operandi of pig butchering scams in Southeast Asia

In an era defined by rapid technological advancement and globalization, the landscape of financial crime has undergone a profound transformation. Against this backdrop, the recent RAW Compliance webinar titled "Exploring the Depths: Underground Banking, AML Typologies, and Threats" provided a platform for industry experts to dissect the intricacies of underground banking, illuminate evolving anti-money laundering (AML) typologies, and underscore emerging threats facing financial systems worldwide.

Oonagh van den Berg, Founder of RAW Compliance, and Mark Nuttall, a seasoned expert in financial crime prevention, embarked on a comprehensive exploration of the clandestine world of underground banking.

Oonagh van den Berg, Founder of RAW Compliance, and Mark Nuttall, a seasoned expert in financial crime prevention, embarked on a comprehensive exploration of the clandestine world of underground banking.

Emerging threats have far-reaching implications beyond their geographic origins

In January 2024, the United Nations Office on Drugs and Crime (UNODC) released a report shedding light on the escalating threat of organized crime in eastern Southeast Asia. While some may question the relevance of such developments to their own lives, whether they reside in the UK, study in the US, or live elsewhere in regions like Africa or the Middle East, the reality is that these emerging threats have far-reaching implications beyond their geographic origins.

The challenge lies in the fact that these criminal activities are not confined to the borders of the countries where they originate. Take, for instance, the insidious phenomenon known as "pig butchering" scams, which predominantly unfold in Thailand and along the border with Myanmar. These scams operate within compounds purposefully constructed to detain individuals, many of whom are victims of trafficking or abduction.

The challenge lies in the fact that these criminal activities are not confined to the borders of the countries where they originate. Take, for instance, the insidious phenomenon known as "pig butchering" scams, which predominantly unfold in Thailand and along the border with Myanmar. These scams operate within compounds purposefully constructed to detain individuals, many of whom are victims of trafficking or abduction.

“The victims aren't just the people that lose the money - there's a massive trade of human trafficking happening behind this.” - Oonagh van den Berg

The recruitment process begins innocuously enough, with job advertisements for seemingly legitimate positions such as roles within multinational corporations or call centres. Prospective candidates, often unsuspecting individuals, travel to Thailand for interviews, only to find themselves ensnared upon arrival. They are whisked away from the airport, disoriented by unfamiliar surroundings, and ultimately coerced into participating in virtual crimes orchestrated over the internet.

The victims that are then targeted in these schemes reside overseas, spanning locations such as the UK, the US, and various other countries. Despite the physical distance separating them from the crime scenes, these individuals find themselves unwittingly embroiled in criminal activities orchestrated from afar.

The victims that are then targeted in these schemes reside overseas, spanning locations such as the UK, the US, and various other countries. Despite the physical distance separating them from the crime scenes, these individuals find themselves unwittingly embroiled in criminal activities orchestrated from afar.

“I don't like using the word scam because it's starting to become so entrenched in modern day language that people forget that in the legislative books it’s fraud – and fraud is a complex crime to prosecute.” - Mark Nuttal

What is Pig Butchering?

Pig butchering, a term coined for its deceptive nature, involves the exploitation of unwitting individuals as unwitting money mules. Perpetrators entice victims—often vulnerable individuals or those facing financial hardship—into laundering money on their behalf. The process typically begins with the promise of lucrative financial gains through seemingly innocuous tasks, such as receiving funds into their personal accounts and transferring them elsewhere. However, unbeknownst to the victims, these funds are derived from illicit activities, including drug trafficking, cybercrime, and human trafficking.

The webinar shed light on the dangers inherent in pig butchering scams, highlighting the dire consequences faced by unwitting participants. Once ensnared in the web of illicit financial transactions, victims risk becoming unwitting accomplices to money laundering and facing severe legal repercussions. Moreover, the emotional and psychological toll inflicted upon victims can be profound, as they grapple with feelings of betrayal, shame, and financial ruin.

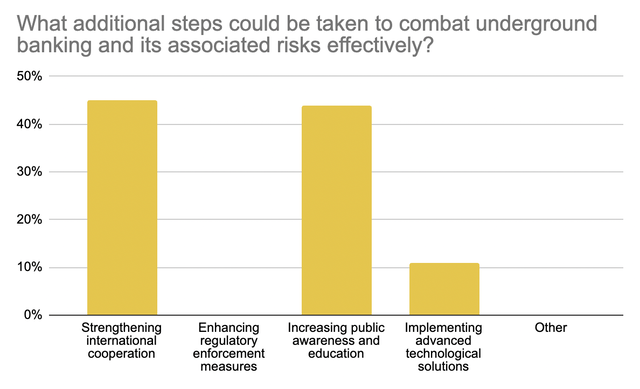

Van den Berg and Nuttall underscored the insidious nature of pig butchering scams, which exploit vulnerabilities and prey upon individuals' trust and desperation. They emphasized the urgent need for heightened awareness, education, and vigilance to thwart the proliferation of such schemes. Additionally, the webinar underscored the importance for enhanced collaboration between law enforcement agencies, financial institutions, and regulatory bodies to dismantle underground banking networks and disrupt illicit financial flows.

The webinar shed light on the dangers inherent in pig butchering scams, highlighting the dire consequences faced by unwitting participants. Once ensnared in the web of illicit financial transactions, victims risk becoming unwitting accomplices to money laundering and facing severe legal repercussions. Moreover, the emotional and psychological toll inflicted upon victims can be profound, as they grapple with feelings of betrayal, shame, and financial ruin.

Van den Berg and Nuttall underscored the insidious nature of pig butchering scams, which exploit vulnerabilities and prey upon individuals' trust and desperation. They emphasized the urgent need for heightened awareness, education, and vigilance to thwart the proliferation of such schemes. Additionally, the webinar underscored the importance for enhanced collaboration between law enforcement agencies, financial institutions, and regulatory bodies to dismantle underground banking networks and disrupt illicit financial flows.

Importance of International Collaboration

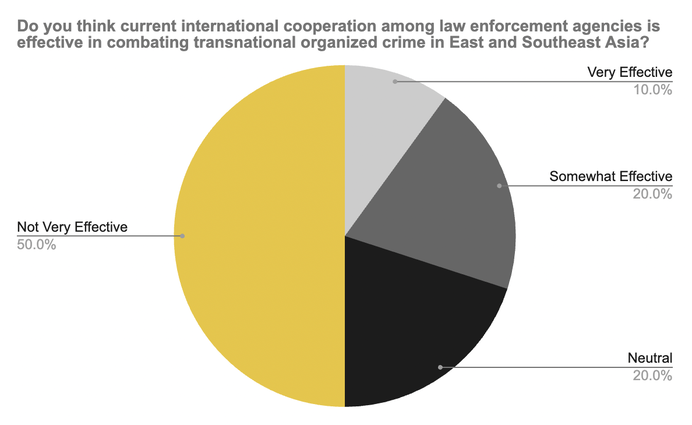

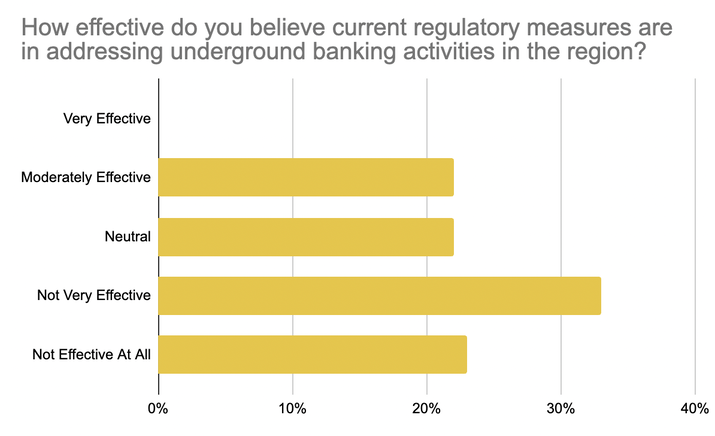

The implications of these cross-border crimes are profound and demand a coordinated response on an international scale. By understanding the interconnected nature of modern criminal enterprises and the global reach of their operations, stakeholders can work collaboratively to disrupt illicit networks, dismantle trafficking rings, and ensure justice for victims wherever they may be located.

International collaboration emerged as a cornerstone in the fight against financial crime, particularly in the context of transnational criminal networks. Van den Berg and Nuttall emphasized that no single jurisdiction can effectively combat the global scourge of underground banking and money laundering in isolation. Instead, a concerted effort involving cross-border cooperation, information sharing, and coordinated enforcement actions is essential to stem the tide of illicit financial activities.

The webinar highlighted successful examples of international collaboration, such as joint task forces, information exchange agreements, and mutual legal assistance treaties. By pooling resources, expertise, and intelligence, countries can amplify their efforts to identify, investigate, and prosecute financial criminals operating across borders. Moreover, international collaboration facilitates the alignment of regulatory frameworks and enforcement practices, ensuring a cohesive and coordinated approach to combating financial crime on a global scale.

Looking ahead, the importance for international collaboration in combating underground banking and associated threats remains paramount. As financial systems become increasingly interconnected and technology-driven, the need for coordinated action has never been greater.

Combating transnational crime requires vigilance, cooperation, and a steadfast commitment to upholding the rule of law. Only through concerted efforts and international collaboration can we effectively address the scourge of organized crime and protect vulnerable individuals from falling prey to its insidious grasp, regardless of their geographic location.

By fostering partnerships, fostering trust, and fostering a culture of collaboration, stakeholders can collectively fortify defences against illicit financial activities and safeguard the integrity of the global financial system.

International collaboration emerged as a cornerstone in the fight against financial crime, particularly in the context of transnational criminal networks. Van den Berg and Nuttall emphasized that no single jurisdiction can effectively combat the global scourge of underground banking and money laundering in isolation. Instead, a concerted effort involving cross-border cooperation, information sharing, and coordinated enforcement actions is essential to stem the tide of illicit financial activities.

The webinar highlighted successful examples of international collaboration, such as joint task forces, information exchange agreements, and mutual legal assistance treaties. By pooling resources, expertise, and intelligence, countries can amplify their efforts to identify, investigate, and prosecute financial criminals operating across borders. Moreover, international collaboration facilitates the alignment of regulatory frameworks and enforcement practices, ensuring a cohesive and coordinated approach to combating financial crime on a global scale.

Looking ahead, the importance for international collaboration in combating underground banking and associated threats remains paramount. As financial systems become increasingly interconnected and technology-driven, the need for coordinated action has never been greater.

Combating transnational crime requires vigilance, cooperation, and a steadfast commitment to upholding the rule of law. Only through concerted efforts and international collaboration can we effectively address the scourge of organized crime and protect vulnerable individuals from falling prey to its insidious grasp, regardless of their geographic location.

By fostering partnerships, fostering trust, and fostering a culture of collaboration, stakeholders can collectively fortify defences against illicit financial activities and safeguard the integrity of the global financial system.

What next?

In conclusion, the RAW Compliance webinar served as a rallying cry for enhanced international collaboration in the fight against underground banking, AML typologies, and emerging financial threats. By uniting forces and harnessing the collective power of nations, stakeholders can effectively confront the challenges posed by financial crime and pave the way for a safer, more secure financial future for all.

Written by Oonagh van den Berg, CEO & Founder of RAW Compliance and Virtual Risk Solutions (VRS). She is an award winning compliance officer with over 20 years’ experience in financial services. She is one of the leading voices and trainers globally in compliance risk management and has built and led various compliance risk framework developments and teams across the industry for a diverse range of financial entities, including traditional banks, Fintechs, and Crypto firms. She is also an advocate for ethical compliance leadership and framework development, with increased automation including AI and Machine Learning integration.